California’s economic growth and investment in education are at an all time high and the latest budget promises even more money. The Mercury News covered this

Gov. Gavin Newsom will have an advantage that Jerry Brown didn’t have in his first year in office nearly eight years ago: more, not less, money for K-12 schools and community colleges.

In its first look at the fiscal year starting July 1, 2019, the Legislative Analyst’s Office is forecasting a $2.4 billion funding increase under Proposition 98, the formula that determines the minimum amount of state revenue for K-14 education.

Together with current one-time spending that will be freed up, community colleges and schools will have $2.8 billion more to spend next year. This 3.1 percent increase

However, districts across the State are hurting, and very few are hurting more than OUSD, which is facing a series of painful cuts, both in the short term and long term, and a big issue is the pension crisis.

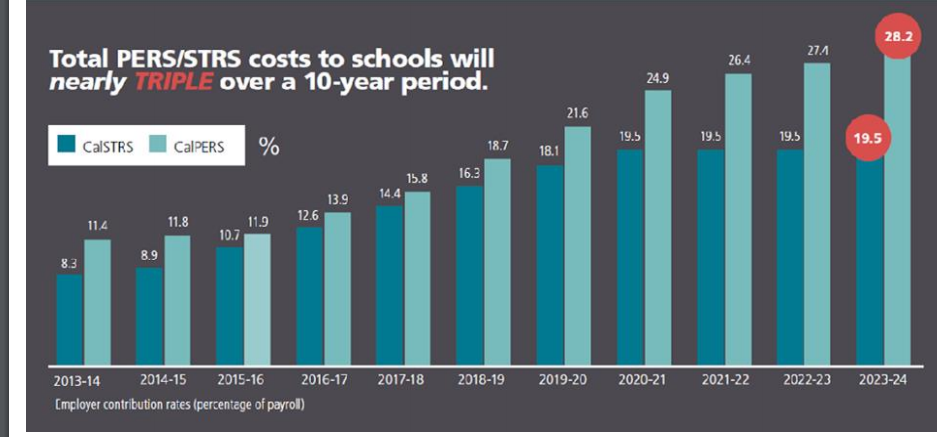

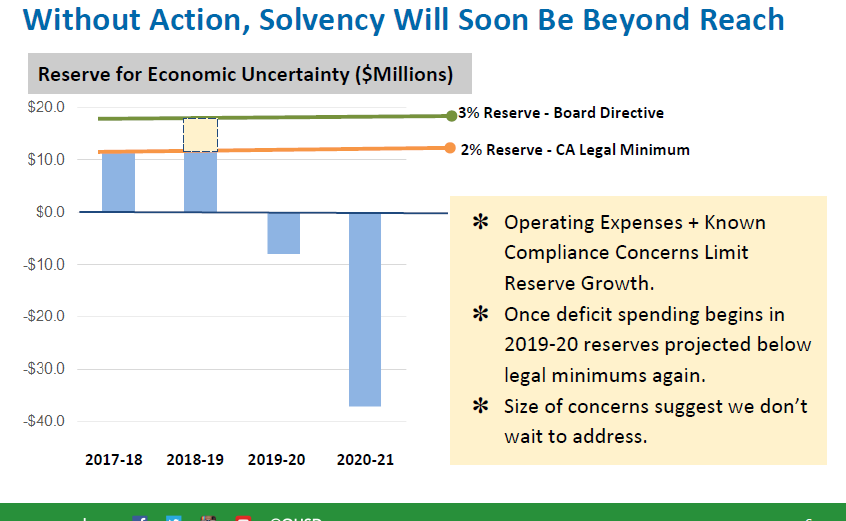

Here is a look at OUSD’s budget projections and pension cost growth

And the actual budget, and upcoming cuts

Part of this is mismanagement and the OUSD’s board’s timidity in facing down the district’s structural issues. But part of this is the State’s political failure to address its pension crisis, and offloading those costs on current schools and youth.

California’s Pension Bomb, The Critical Issue that Bores Us to Inaction

Until we address the pension issues in CA, we will never adequately address school funding. Please stick with me. The State perpetuates a fraud on the taxpayers and employees that current schools pay for. As far as I can remember the pension boards in CA used unrealistic assumptions to set pension rates—things like getting a 7% return on investments each and every year. This has created a huge deficit in our teacher and school employee pension funds.

Cal Matters described the situation

The problems stem from the state Legislature’s reticence to mandate steeper payments into the California State Teachers’ Retirement System. The system was badly underfunded and careening toward collapse four years ago when school districts, teachers and the state all agreed to pay more to reduce its unfunded liability, which now stands at $107 billion.

Districts took on the greatest share of those new costs, agreeing to increase payments from 8 percent of their payroll in 2013 to 19 percent by 2020.

Payroll typically consumes around 80% of school budgets, so nearly tripling the retirement costs really hurts. Remember that all of this is happening during a period of unprecedented economic growth. Growth that will receded eventually.

The Answer

While unpalatable and expensive, the state needs to bail out the pension funds, and we need to get honest about what it takes to fund pensions and how we will get there. None of this is sexy or fun, and there isn’t some great photo op, but current schools can’t keep paying for past obligations, not if they want to meet their obligations to current students and families.

We have kicked the can down the road about as far as we can, it’s time that someone step up and pick it up.

Re: Pensions. At firt I thought it was just another screed against public employees, but you did not go there. We probably disagree on structural changes, but I do agree it is time to fix the pensions, and that the state should take on that burden. Then the teachers could bargain for the future. In the past, they were given better and better pension terms in exchange for low salaries. The true cost of pensions should be analyzed and a new balance (perhaps) of pensions and salaries could be worked out.

California Proposition 98 requires a minimum percentage of the state budget to be spent on K-12 education. Prop 98 guarantees an annual increase in education in the California budget. … Proposition 98 can be suspended only by a two-thirds vote of the California Legislature.

Proposition 98 is a floor and not a ceiling and therefore the State of California can spend more on its part of teacher retirement. including inflation retirement contribution, this year the State paid a part of teacher retirement that was about 10% while the employee also paid close to 10%.

A reasonable adjustment would be for the State to meet the employer about half way and for the State and employer pay 14.5%.